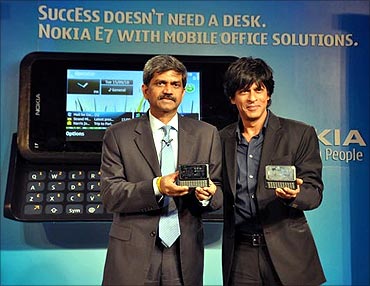

Mumbai, Apr 18 : At the launch of the company's latest communicator device E7, D Shivakumar, managing director and vice-president for Nokia India, was inundated with questions from the media on Nokia's steady decline in market share and gradual increase of Android's - Google's open source mobile operating systems - share in India.

But Shivakumar displayed no signs of irritation while he patiently addressed journalists' queries.

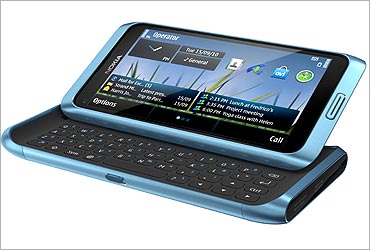

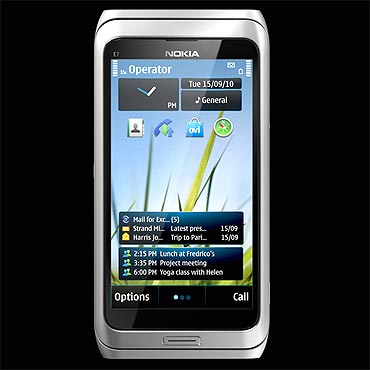

A calm-looking Shivakumar refused to fidget even when a video call demonstrated on the E7 device failed to run during the press event.

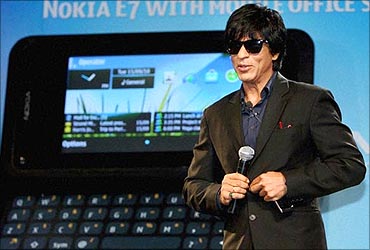

He instead got company's brand ambassador Shah Rukh Khan to address the media about the newest device and his experiences with the E7.

In simple words, managing the media and its queries now comes easily to Shivakumar: after all, he has been managing the India business for the Finnish company for about five years.But behind a facade of calm Nokia is preparing for a bitter battle for market shares.

While at the lower end of the market, smaller local manufacturers are giving the world's top cell phone maker a run for its money, at the upper end - in the critical smartphone segment - Nokia is struggling against stiff competition from innovative software makers Apple and Google.

It is the availability and success of Google's free open source Android platform that has made entry and expansion in the smartphone market easier for a number of hardware manufacturers in India which have chosen to join Android's ecosystem, especially at the mid-to-low range of the smartphone market. This is where Nokia has been hit the hardest.

A comeback is being planned at Nokia. In India, Shivakumar and his team are busy pushing out services and utility tools on mobile devices that will improve the user interaction with the internet.

"We have added 5 million songs on our music service, introduced accurate real time crop data for farmers at Rs 30 per month, bundled data plans with handsets to encourage free surfing on mobile, and even introduced social networking phones at the mid level," lists Shivakumar.

The company is now eyeing the replacement market that is expected to get people to switch to bigger "trustworthy" brands like Nokia.

"It's time we leverage our market position and brand in emerging markets to increase sales here," says Shivakumar.

Nokia India, which is second biggest market for the company after China, contributed 2,809 million Euros (Rs 18,000 crore) to the company's worldwide sales in 2009.

To put things in perspective, the Indian mobile handset market has grown by 30.17 per cent from 116 million handsets as on December 31, 2008, to 151 million handsets as on December 31, 2009, as per Analysys Mason data.

The growth has been driven by the growth in mid-priced devices - in the range of Rs 2,000 to Rs 5,000.

Market research firm CyberMedia Research recently released a report that predicted the Indian mobile handset market to grow 25 per cent by volume in 2011 to 210 million units with smartphones contributing sales of nearly 12 million units in 2011.

"Smartphones are mobile devices with evolved operating systems, that include Symbian Series 60, Android OS, iPhone OS, Blackberry OS, Linux among others," says Siddharth Neri, analyst, mobile devices research, India telecoms practice at CyberMedia Research.

Nokia's India act

Having seen a market share erosion of more than 40 per cent in the last three years in India, Nokia is keen to uphold itself as a brand that can be trusted - a direct answer to naysayers who suppose the local handset brands have eaten into Nokia's share at the entry level.

This also explains why the Finnish giant is wooing popular Bollywood stars like Shah Rukh Khan and Priyanka Chopra as the brand ambassadors for its devices who can communicate the "trust" factor to the consumers.

Shah Rukh Khan, who reportedly tested the E7 before it was launched, is seen promoting the device on ad breaks during the Indian Premier League telecast on television.

But smart marketing will not alone save Nokia and the company knows that. That's why Shivakumar says, "Nokia excels at providing low-cost handsets in high volumes - affordable, simple user interfaces and handsets with software that one can consume and not just fancy."

Nokia claims that it has fine-tuned its approach for the entry level. "We will launch several low-cost dual SIM handsets with features like camera and radio that are much in demand," says Shivakumar.Nokia can take comfort in the fact the brand still rules over the mobile handsets market in India with a 56 per cent top-of-mind recall followed by Samsung and then LG.

As per the Mobile Handsets Usage And Satisfaction Study 2011 of over 4,425 respondents conducted by CyberMedia Research, Nokia remains the most well recognised brand in terms of 'total awareness', but emerging Indian brands like Micromax and Spice too have managed to attract a large following.

But competition is breathing down Nokia's neck.

At last count, well over 200 mobile handset brands were available at retail outlets across the country, according to CyberMedia Research (CMR).

According to Anirban Banerjee, associate vice-president, research and consulting, CMR India, "Indian handset buyers are increasingly more feature conscious, applications aware and value conscious, rather than being plain 'brand loyal' in the traditional sense of the term."

He adds, "Emerging mobile handset players with their highly innovative features have been able to influence the first time buyers, especially the youth and blue collar executives."

It is not only competing with established brands like Research in Motion, the maker of BlackBerry, Apple and Samsung, but Nokia has to also beat the threat from smaller local players, who have unleashed a virtual tsunami of copycat models with almost similar features that match those of high-end branded models, but at much lower prices.

Result: Brands like Micromax, GFive, Spice, among others have already grabbed a sizeable chunk of the domestic handset market.

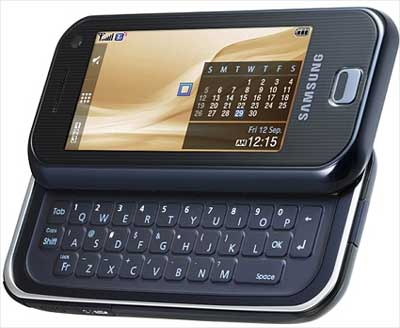

Korean electronics giants LG and Samsung have already upped their R&D focus to make value additions for Indian mobile users.

Samsung says it has made significant investments in its software R&D centre in Noida and has a team of 20 engineers working on customising smartphone platforms for Indian users. Samsung India Software Operations Vice-president Dipesh Shah says, "We are sure to capture a market share of at least 40 per cent in 2011."

Shah is hopeful that the company's Andriod-based smartphones as well those running on Bada, its own mobile operating system, will provide the brand enough differentiation to give it a big market push in 2011.

The confidence stems from the fact that Samsung puts over 8 per cent of its global spends into R&D every year and India is amongst the only four markets to have a dedicated product innovation team outside the US, UK and China.

LG, too, is betting big on smartphones. It plans to launch 10 handsets under its Optimus smartphone brand this year, which will include a 3D phone as well as a dual-core processor (faster processing power) phone.

"With Optimus models we will have smartphones in the high end as well as for the first-time smartphone users. Since the demand for smartphones is accelerating with 3G in India, LG expects to generate 20-25 per cent revenue from new smartphones," says Vishal Chopra, business head, mobile communications, LG India.

Nokia had announced its new strategy, leadership team and operational structure for devices and services business on February 11, 2011, designed to focus on speed, results and accountability.

Effective April 1, 2011, there will be two business units: Smart Devices, focused on smartphones, and mobile phones, focused on mass-market mobile phones.

"The new strategy also involves changing our mode of working and culture to facilitate speed and agility in our innovation, product development and execution and accountability for results," lists Shivakumar.

The Micro (soft) bite

Last month, a broad strategic partnership was announced between Microsoft and Nokia. Microsoft's Windows Phone would serve as Nokia's primary smartphone platform, announced Nokia's new CEO Stephen Elop, himself an ex-Microsoft employee.

"A renewed approach to capture volume and value growth to connect 'the next billion' to the internet in developing growth markets," underlined Elop.

What he didn't say was that other smartphone platforms with their related ecosystems have continued to gather momentum and market share, specifically Apple's iOS proprietary platform and Google's open source Android platform.

Until very recently, Nokia believed its competitive position in smartphones could be improved with Symbian - that's when it launched the Nokia N8 device that supported Symbian 3 OS.

Shivakumar too concurs that for the long term the Symbian platform will not be sufficient in pocketing the smartphone users.

Last month, Nokia even outlined the risks of its decision to partner with Microsoft, in a regulatory filing highlighting many of the issues raised by critics, primarily the hiatus period before it can launch devices running Windows Phone 7 (WP7) - a period that condemns the company to another year in the smartphone wilderness.

Nokia says it is aiming to expand the Microsoft operating system into mass markets, and even wrote in the regulatory filing that, "This strategy recognises the opportunity to retain and transition the installed base of approximately 200 million Symbian owners to Nokia Windows Phone smartphones over time. We expect to sell approximately 150 million more Symbian devices in the years to come, supported by our plan to deliver additional user interface and hardware enhancements."

Other risk factors highlighted by Nokia include the relative immaturity of the Windows Phone 7, a mobile operating system developed by Microsoft as the successor to its Windows Mobile platform.

"The Windows Phone platform is a very recent, largely unproven addition to the market focused solely on high-end smartphones with currently very low adoption and consumer awareness relative to the Android and Apple platforms, and the proposed Microsoft partnership may not succeed in developing it into a sufficiently broad competitive smartphone platform," says the document, which acknowledges that other "more competitive alternatives" might have delivered market share more rapidly.

Back in India, Shivakumar does not even bat his eyelids as he replies to a query on effect of the partnership in India. "It's a win-win deal," he quips.

"India is set to become a 4 million unit smartphone market by 2014 and the Windows 7-Nokia platform is intended for the smartphone devices."

And while Shivakumar admits that older mobile operating systems like Symbian didn't stand a chance against new mobile OSes like Android and Apple iOS, Nokia is certain the new Windows 7 platform will be the key to

0 comments:

Post a Comment