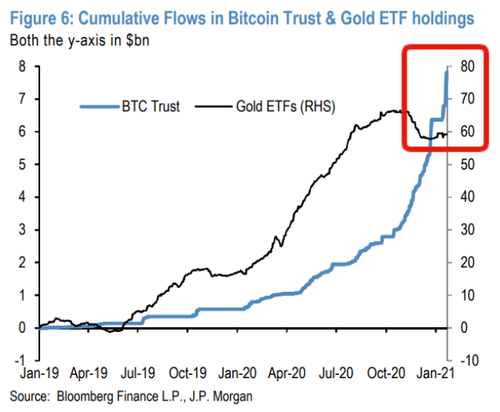

"...private gold wealth is mostly stored via gold bars and coins the stock of which, excluding those held by central banks, amounts to 42,600 tonnes or $2.7tr including gold ETFs. Mechanically, the market cap of bitcoin at $600bn currently would have to rise by almost x4.5 from here, implying a theoretical bitcoin price of $146k, to match the total private sector investment in gold via ETFs or bars and coins."

Source; JPM

This is just a theoretical exercise. Before serious investments in bitcoin could occur, volatility would need to converge and trade at similar levels to gold volatility. Fund managers need to allocate money according to volatility of each asset. Bitcoin vol converging to gold volatility seems rather distant as of writing.

On the other hand, average of bitcoin 1-2 mth bitcoin vol is around 85%. GLD 1-2 mth average vol stands around 18%. That is aprox 4.7x higher vol for bitcoin than gold. Apply the 4.7x to bitcoin's $600bn market and we have a "vol adjusted" market cap of bitcoin matching gold. This is why we at TME have been coming back to the argument explaining that most people have no clue of how to manage downside volatility, and we see this as the biggest "risk" for "non dynamic bitcoin fans".

So while many are arguing bitcoin is the new gold going forward, you could argue it is already here.

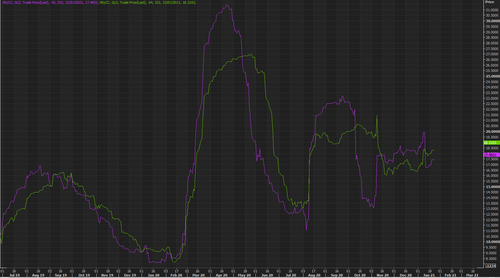

Source; Refinitiv

It is easy to get carried away by a narrative that has worked, you made money and lately your p/l diminishes, but you still trade the old narrative. This has partly become the case with bitcoin lately. Same arguments are made, but the price has been all but rosy.

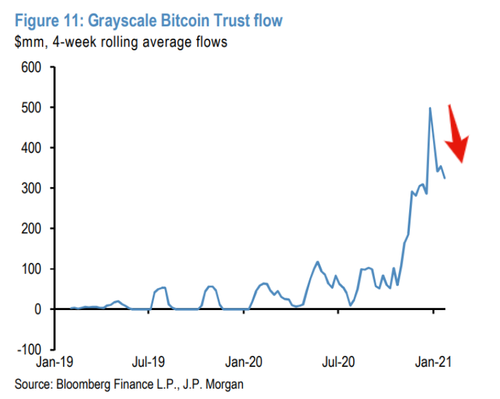

Institutional buying sure, but let's not forget, institutions also have to manage risk, so the new hot buys at 42k by some "smart" guys will need to be sold when bitcoin falls. Grayscale bitcoin trust flow has been declining lately...

Source; JPM

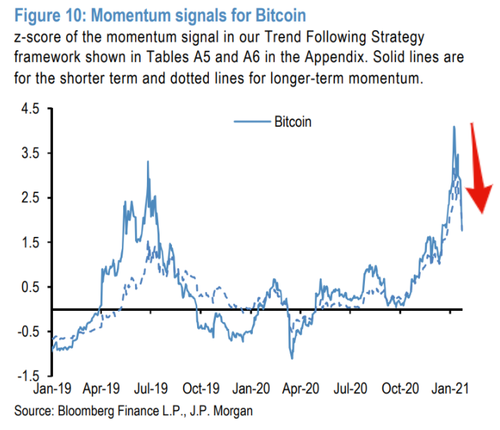

With regards to momentum strategies that were pressing momentum higher, especially during the illiquid Xmas and New Year weekends we outlined weeks ago, they have no directional preference or bias.

Momentum traders do not care about no blockchain nor fundamentals. They chase momentum and have no emotions. Lately these momentum models are all but pointing higher...

Source; JPM

What about the short term px action? TME has been pointing out "why not try the 50 day moving average" over past weeks (note Fibonacci 38.2% level trades around that level as well). It would would be a first real support to see how well new smart bulls have managed downside exposure...

Source; Refinitiv

0 comments:

Post a Comment